Casper, Wyoming

307.258.1208

Buford, Wyoming

altitudesoaps@gmail.com

Altitude Soaps LLC is a Wyoming-based artisan soap company where the motto is “beautiful and functional, handmade at Altitude.” It’s not enough for me that a humble soap should simply work; it needs to bring joy, and I accomplish this by utilizing a wide array of colors, of lovely fragrances, and fun designs you just can’t get from your local grocery store.

I’m also looking to break into custom work, so if you need a gift for your bridal shower, wedding shower, baby shower or whatever, consider the benefits of a custom batch of soap or guest soaps:

So if you need a great gift, have a look at my website and see if anything catches your eye. If you need a unique gift, get in contact with me through my website, and we’ll see what kind of gorgeous soap can be worked out for you.

~Martha Tumer,

Soap Artist, Altitude Soaps LLC

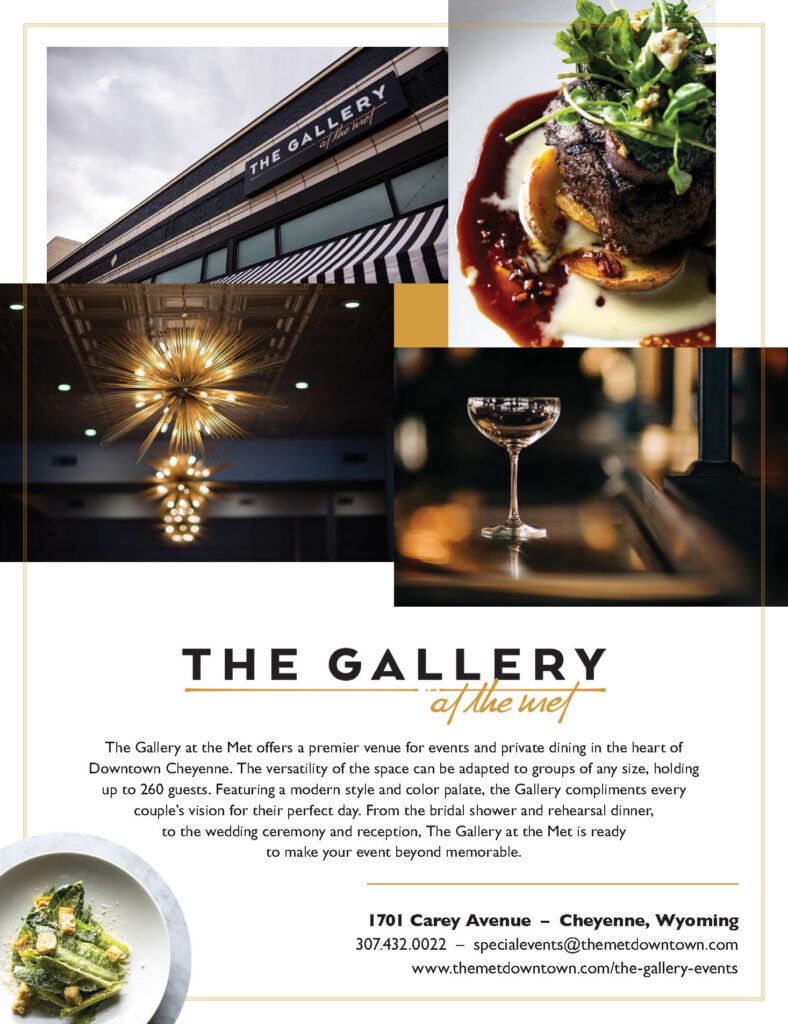

Cheyenne, Wyoming

307.432.0022

Spaces are available for Daytime reservations beginning at regular business hours and ending by 3:30 PM. Evening reservations start at 4:30 PM or after and end at regular business hours. If you wish to reserve the space beyond these timeframes, special arrangements can be made in some cases and may be subject to additional charge.

The Metropolitan Downtown offers a wide range of catering capabilities from modest business lunches to large parties and so much more! We will work with you to create a custom catering plan to suite your event.

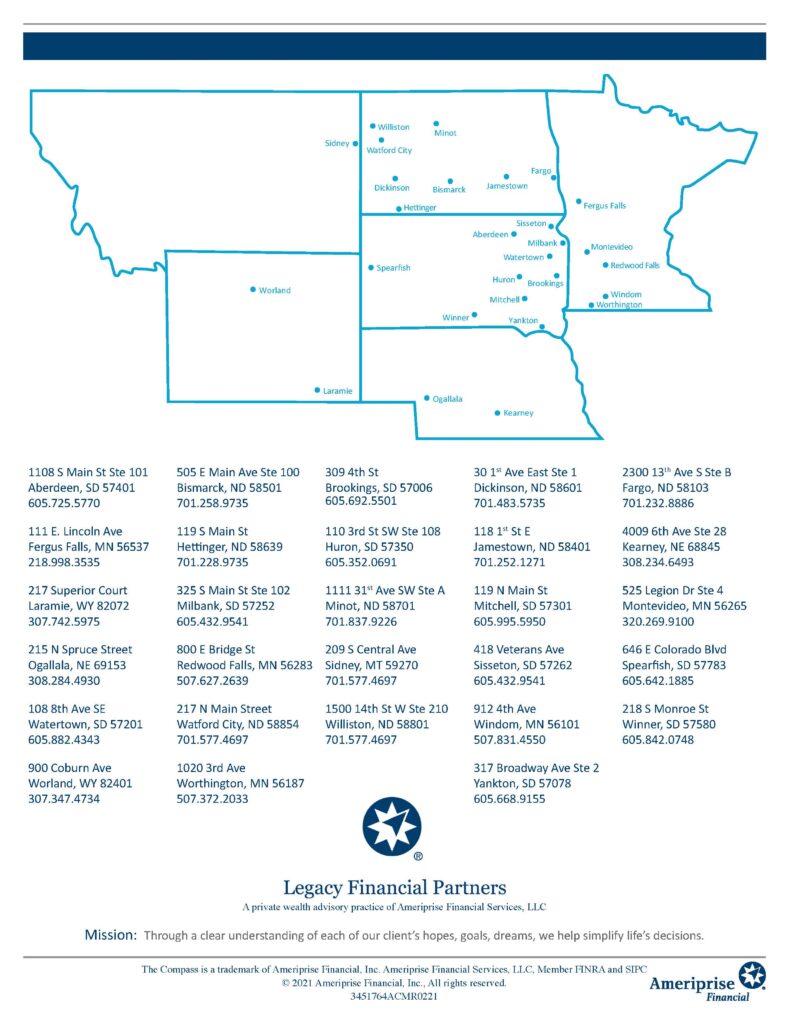

Contact Ameriprise Financial Advisor Margaret H. Meranda

Contact Ameriprise Financial Advisor Amie Lamborn

Contact Ameriprise Financial Advisor Margaret H. Meranda

Contact Ameriprise Financial Advisor Amie Lamborn

Getting married is exciting, but it brings many challenges. One such challenge that you and your spouse will have to face is how to merge your finances. Planning carefully and communicating clearly are important, because the financial decisions that you make now can have a lasting impact on your future.

Discuss your financial goals

The first step in mapping out your financial future together is to discuss your financial goals. Start by making a list of your short-term goals (e.g., paying off wedding debt, new car, vacation) and long-term goals (e.g., having children, your children’s college education, retirement). Then, determine which goals are most important to you. Once you’ve identified the goals that are a priority, you can focus your energy on achieving them.

Prepare a budget

Next, you should prepare a budget that lists all of your income and expenses over a certain time period (e.g., monthly, annually).

You can designate one spouse to be in charge of managing the budget, or you can take turns keeping records and paying the bills. If both you and your spouse are going to be involved, make sure that you develop a record-keeping system that both of you understand. And remember to keep your records in a joint filing system so that both of you can easily locate important documents.

Begin by listing your sources of income (e.g., salaries and wages, interest, dividends). Then, list your expenses (it may be helpful to review several months of entries in your checkbook and credit card bills). Add them up and compare the two totals. Hopefully, you get a positive number, meaning that you spend less than you earn. If not, review your expenses and see where you can cut down on your spending.

Bank accounts–separate or joint?

At some point, you and your spouse will have to decide whether to combine your bank accounts or keep them separate. Maintaining a joint account does have advantages, such as easier record keeping and lower maintenance fees. However, it’s sometimes more difficult to keep track of how much money is in a joint account when two individuals have access to it. Of course, you could avoid this problem by making sure that you tell each other every time you write a check or withdraw funds from the account. Or, you could always decide to maintain separate accounts.

Credit cards

If you’re thinking about adding your name to your spouse’s credit card accounts, think again. When you and your spouse have joint credit, both of you will become responsible for 100 percent of the credit card debt. In addition, if one of you has poor credit, it will negatively impact the credit rating of the other.

If you or your spouse does not qualify for a card because of poor credit, and you are willing to give your spouse account privileges anyway, you can make your spouse an authorized user of your credit card. An authorized user is not a joint cardholder and is therefore not liable for any amounts charged to the account. Also, the account activity won’t show up on the authorized user’s credit record. But remember, you remain responsible for the account.

Insurance

If you and your spouse have separate health insurance coverage, you’ll want to do a cost/benefit analysis of each plan to see if you should continue to keep your health coverage separate. For example, if your spouse’s health plan has a higher deductible and/or co-payments or fewer benefits than those offered by your plan, he or she may want to join your health plan instead. You’ll also want to compare the rate for one family plan against the cost of two single plans.

It’s a good idea to examine your auto insurance coverage, too. If you and your spouse own separate cars, you may have different auto insurance carriers. Consider pooling your auto insurance policies with one company; many insurance companies will give you a discount if you insure more than one car with them. If one of you has a poor driving record, however, make sure that changing companies won’t mean paying a higher premium.

Employer-sponsored retirement plans

If both you and your spouse participate in an employer-sponsored retirement plan, you should be aware of each plan’s characteristics. Review each plan together carefully and determine which plan provides the best benefits. If you can afford it, you should each participate to the maximum in your own plan. If your current cash flow is limited, you can make one plan the focus of your retirement strategy. Here are some helpful tips:

• If both plans match contributions, determine which plan offers the best match and take full advantage of it

• Compare the vesting schedules for the employer’s matching contributions

• Compare the investment options offered by each plan–the more options you have, the more likely you are to find an investment mix that suits your needs

• Find out whether the plans offer loans–if you plan to use any of your contributions for certain expenses (e.g., your children’s college education, a down payment on a house), you may want to participate in the plan that has a loan provision

IMPORTANT DISCLOSURES

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

757.572.9430